The Data Tapes Edition #34

Asset-Based Finance & Private Credit Newsletter: November Edition I

November 13, 2025 | Read Online

The Latest in ABS and Debt Markets

Welcome to The Data Tapes—your biweekly snapshot of private credit and ABS markets. In each edition, we bring you concise updates on debt financings, platform fundraises, data insights, market trends, and the latest from Setpoint.

🚀 What’s New at Setpoint

🏆 Setpoint Named 2025 Fintech Game-Changer of the Year: We’re honored to be recognized by Opportunity Austin’s 2025 A-LIST Awards for our work modernizing how capital moves through asset-backed finance — bringing transparency, trust, and efficiency to lenders, investors, and borrowers. We’re just getting started, and we’re hiring. Check out open roles.

📣 Hear from Stuart Wall at Citi’s 2025 SPRINT Summit — Nov. 20: Setpoint Co-Founder & CEO Stu Wall will join industry leaders on a panel — View from the Top — at Citi’s 2025 SPRINT Fintech & Private Credit Summit on Thursday, Nov. 20, at Citi’s headquarters. Don’t miss the discussion — register to attend.

🤝 We’re on the road — let’s connect: We’ll be at a few more industry conferences before 2025 comes to a close, and we’d love to meet.

SFR West, Dec. 2-4 — Scottsdale, AZ | Meet with us.

Opal ABS & Fintech Specialty Finance Forum, Dec. 9-11 — Dana Point, CA | Meet with us.

💸 Debt Financings & Acquisitions

Affirm, a buy now, pay later platform, closed a $750M forward flow agreement with New York Life to purchase Affirm’s installment loans between October 2025 and December 2026.

Agren, an Italian Agri Solar project company, closed a €132M senior secured bond facility with Pollen Street to fund the development of 14 sites.

America’s Car Mart, a buy here, pay here used car dealership, closed a $300M term loan with Silver Point Capital.

Americor, a debt settlement platform, closed a $153.1M ABS issuance backed by debt settlement fees.

Beka Credit, a Spanish investment manager focused on renewable energy development and financing, closed a senior debt facility supporting Alameda, a €200M renewable debt fund.

Commercial Equipment Finance (CEFI), a commercial equipment finance platform, closed a $122.36M ABS issuance backed by equipment loans and leases.

CoreWeave, an AI hyperscaler, expanded its revolving credit facility to $2.5B with JPMorgan, Goldman, Morgan Stanley, MUFG, and others.

Foundation Finance, a home improvement originator, closed a $441.1M ABS issuance backed by a pool of retail installment contracts to fund home improvements.

Holiday Inn Club Vacations, Holiday Inn’s timeshare business, closed a $229.3M ABS issuance backed by a pool of timeshare assets.

Kapitale, a SMB lending platform, closed a $25M credit facility with Pier Asset Management.

Kiwi, a consumer finance platform for underbanked Hispanic consumers in the US, closed a $100M credit facility from CIM.

LCP Group, a vertically integrated real estate investment manager specializing in net lease and hospitality, entered into a $50M JV with Oaktree to target high quality net leased education properties.

Metropolis, a technology platform for parking facilities and asset owner, closed a $1.1B Term Loan B arranged by JP Morgan alongside a $500M Series D equity financing led by LionTree.

Mobile Infrastructure Corporation, an owner of parking infrastructure, closed a $100M ABS facility secured by 19 of the company’s parking assets.

Nexamp, a clean energy platform, closed a $600M aggregation facility with ATLAS SP to fund construction of distributed solar and energy storage projects.

Octane, a financial platform for recreational purchases, closed a $284M ABS deal secured by fixed-rate installment powersports loans.

Pagaya, a consumer finance and residential real estate platform, closed a $500M forward flow agreement with Castlelake to purchase auto loans sourced through Pagaya’s platform.

Phoenix Aviation Capital, a full-service aircraft lessor managed by AIP Capital, closed a $592M term loan with Morgan Stanley, Citi, and RBC.

Point, a home equity investment platform, along with funds managed by Blue Owl, closed a $390M rated ABS deal.

R2, an embedded lending platform in Latin America, received a strategic investment from Ant Financial.

Regional Management, a diversified consumer finance platform, closed a $253M ABS issuance.

Sallie Mae, a private student lender, closed a strategic partnership with KKR to purchase an initial seed portfolio of private education loans followed by a minimum of $2B in loans annually.

Shawbrook, a UK-based digital banking and lending platform, went public on the London Stock Exchange valued at just over £2B.

Spotawheel, a European used car platform, closed a senior credit facility with Pollen Street as part of a €300M financing.

Upstart, a consumer finance platform, closed a $1.5B forward flow agreement with Castlelake to expand their existing partnership.

VoltaGrid, a provider of modular power solutions for hyperscale data centers, closed a $5M financing package made up of $2B in second lien notes and a $3B asset-based credit facility.

Willis Lease Finance, a commercial aircraft lessor, closed a $750M credit facility for its joint venture with Mitsui & Co.

💰️Platform Growth

AIG to buy stakes in Convex Group, a specialty insurer, and Onex Group, an alternative asset manager in transactions that exceed $2.7B.

Bridge Investment Group closed $2.15B in equity commitments for its Bridge Debt Strategies V to originate mortgage direct loans, CRE CLOs, and other CRE-backed debt.

Clearlake Capital acquired Pathway Capital Management to bolster Clearlake’s private credit origination capabilities.

D2 Asset Management completed the acquisition and integration of Residential Capital Partners, a Dallas-based private real estate lender serving single family real estate investors.

Generate, a sustainable infrastructure investment platform, raised over $1B across its infrastructure credit strategies.

Jain Global is launching a new $600M+ fund led by Syril Pathmanathan focused on bank capital relief trades.

Pathlight Capital is raising $1.5B for its fourth asset-based lending fund.

Point72 plans to raise at least $1B for a new private credit fund turn by Todd Hirsch.

Promote Giving, a collective of funds inspired by Ares Pathfinder funds that is focused on promoting philanthropy by donating at least 5% of funds’ performance fees to charitable organizations, launched with nine initial asset managers. Those initial nine are Ares, Ascend Partners, Coller Capital, Derby Lane Partners, Makarora, Pantheon, Pretium, Related Fund Management, and Silver Point.

📈 Visuals

🗣️ Market Commentary

“We’re beginning to see huge rating agency arbitrage in the insurance business,” told his fellow financiers at Hong Kong Monetary Authority’s Global Financial Leaders’ Investment Summit on Tuesday. “In 2007, subprime was all about rating agency arbitrage. What you see now is a massive growth in small rating agencies ticking the box for compliance of investment. If we look at the insurance business, to me, there is a looming systemic risk coming through and it’s because of lack of effective regulation.” - UBS Chairman Colm Kelleher on Purported Insurance Ratings Agency Arbitrage

“The truth is that there are always defaults and not infrequently defalcations (how’s that for a good old-fashioned word?). Over my 47 years in the high yield bond market, more than 2% of all bonds by value have defaulted in a typical year, and many more during crises. If you apply that percentage to the number of sub-investment grade issuers, which runs in the thousands, it shouldn’t come as a surprise if there are a few dozen defaults in a normal year.” - Howard Marks, Oaktree Chairman on Systematic vs Systemic Issues in Private Credit

“When a sector of the credit markets is small or nonexistent, and then becomes more frequent and becomes large, which it’s not yet. When it gets momentum, you’re supposed to be cautious. These transactions, particularly in investment grade, are novel in the way they’re structured, the features in terms of being off balance sheet. I think you’re supposed to be careful. It’s unknowable at the moment whether these capital projects will actually be profitable. We also don’t know how many will be built. They’re building capacity and when you build capacity in fixed assets, sometimes you build too much or not enough because these projects take years to put together. By the time they come online, there might be 100 more projects coming online that could be sufficient or insufficient. It’s really unknown. I think you have to have a level of skepticism.” - Robert Cohen, DoubleLine Director of Global Developed Credit on AI Debt Funding Cautions

“This is fundamentally what people fail to understand. The rotation into private credit is a rotation out of equity. That is what investors are doing. That is what we observe. They are making a decision to take risk off because they perceive the ability to earn long run equity returns in first lien debt, top of the capital structure as an attractive opportunity. But I think we cannot as an industry deny that there was more value, just like there was more value in the equity market. We’re now talking about where we sit in the valuation cycle and the alternatives that we provide. As I suggested, we believe that prices are high, that rates – long rates are not likely to plummet, and that we have enhanced geopolitical risk. And so, as a firm, we are in risk reduction mode. We preach risk reduction. Our balance sheet is in risk reduction mode.” - Mark Rowan, Apollo Chairman & CEO on responses to rotation risk away from credit as yields compress

“You can come out with good recovery from a debt-for-equity swap, but if that’s showing up in strategies where it shouldn’t be, like a senior direct lending strategy, that’s concerning, and I’d worry about high frequencies of this.” - Tamsin Coleman, head of private credit for Europe at Mercer on Growing Risks of Equitizing Debt in Private Credit

📖 What We’re Reading & Listening To

Invester Presentations

AllianceBernstein, Apollo, Ares, Blackstone, Blue Owl, Carlyle, KKR, Rithm, TPG

Reading

ABS East 2025: Seeking Clarity in Complex Markets (AllianceBernstein)

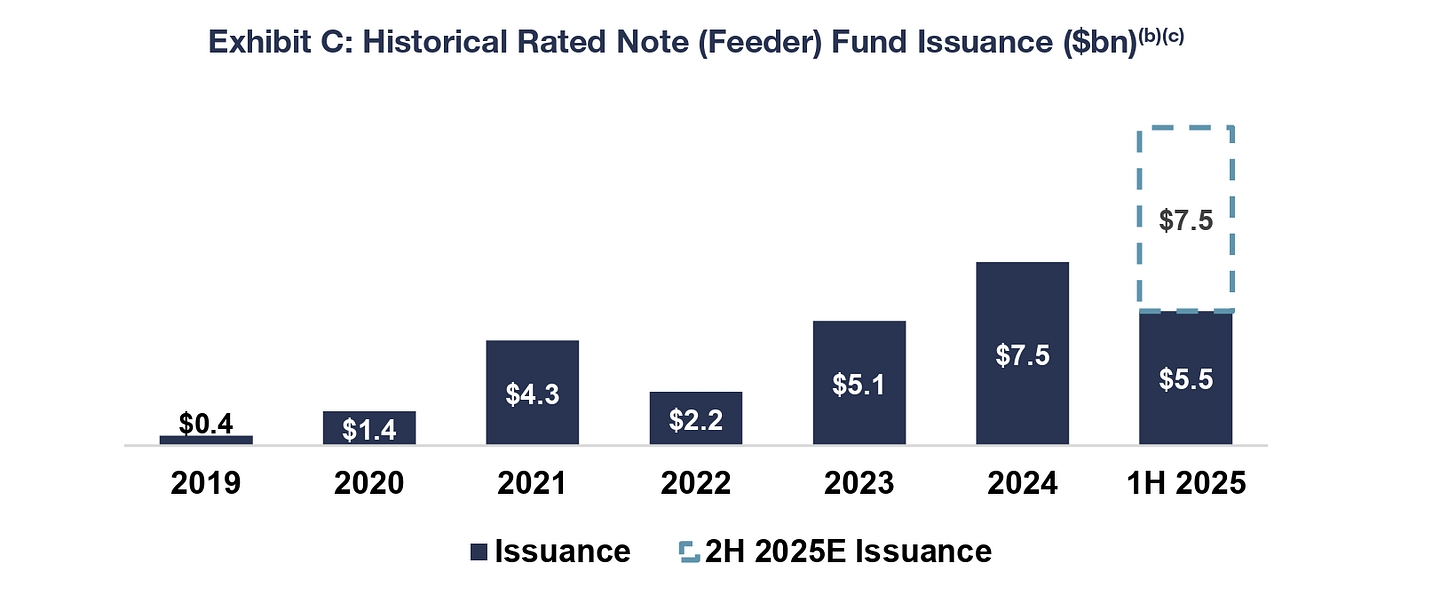

ABS Re-Imagined: Rated Note (Feeder) Funds for Specialty Finance Companies (Edgar Matthews)

BlackRock Stung by Loans to Business Accused of ‘Breathtaking’ Fraud (WSJ)

Capital Allocation: Results, Analysis, and Assessment (MS Consilient Observer)

Cockroaches in the Coal Mine - New Memo from Howard Marks (Oaktree)

How Long Does It Really Take to Build a Home? (Saluda Grade)

Private Credit Enters the Equity Business as Borrowers Struggle (Bloomberg)

Structure as the Secret Sauce: Evolving Beyond Traditional Fund Structures in Direct Lending (KKR)

Tricolor’s Frantic Final Days Began with a Call from JPMorgan (Bloomberg)

Podcasts & Interviews

Jeff Aronson - Building Centerbridge Across the Capital Structure (Capital Allocators)

Macro Challenges and Credit Opportunities: Davidson Kempner’s Tony Yoseloff (Exchanges at GS)

New Mountain’s Kaplan on Net-Lease Landscape (Bloomberg Credit Crunch)

Nomura Global Management’s Robert Stark - building a private credit business within a global bank (Alt Goes Mainstream)

Obscuring the Cycle with Dan Zwirn of Arena Investors (Grant’s Current Yield)

Why and Where (and How) to Invest in Asset-Backed Finance (Guggenheim)