October 15, 2025 | Read Online

The Data Tapes

Setpoint’s Bite-Sized Debt Newsletter: October Edition II

The Latest in ABS and Debt Markets

Welcome to The Data Tapes—your biweekly snapshot of private credit and ABS markets. In each edition, we bring you concise updates on debt financings, platform fundraises, data insights, market trends, and the latest from Setpoint.

🚀 What’s New at Setpoint

💡 Collapse of Tricolor, First Brands: Setpoint Co-Founder & CEO Stuart Wall highlights how these failures reveal a deeper structural issue in asset-backed finance — the lack of standardized infrastructure to verify collateral ownership and quality in real time. Read here.

🚀 We’re hiring: Interested in shaping the future of capital markets? We’re hiring across engineering, finance, growth, operations and more. Check out our open roles.

🤝 Let’s connect: We’ll be at ABS East 2025 Conference next week — Oct. 20-22 — and we’d love to meet. Book time with our team.

🌆 Capital Conversations: On the Water — Nov. 6: Join Setpoint and Comvest Credit Partners for drinks and bites along Miami’s riverside as the sun sets. This open-air gathering will bring together investors, capital providers and borrowers from across the ABF ecosystem — you don’t want to miss it. Apply to attend.

💸 Debt Financings & Acquisitions

Breeze Airways, a US airline targeting underserved markets, closed a $47.5M debt financing with AIP Capital secured by spare parts, a spare engine, and a flight simulator.

Edge Focus, a tech-enabled private credit firm focused on consumer assets, closed its second asset-based securitization with a $200M rule 144A issuance backed by a pool of consumer loans.

Harvest Capital, a land acquisition and development financing platform, announced they’ve exceeded $1B in origination volume since launching in 2021 through their partnership with TPG Angelo Gordon.

Libertas Funding, a small business financing platform, closed a $100M credit facility with Victory Park Capital to scale origination volume.

MidCap Financial, a middle market lending platform owned by Apollo, extended its $1.6B revolver with a bank syndicate including JPMorgan, Truist, BMO, and others.

OppFi, a consumer finance platform, closed a $150M credit facility with Castlelake to scale origination volume and improve financing costs.

Pagaya, a consumer finance and residential real estate platform, upsized its credit facility with a bank syndicate to $132M. Pagaya also closed a $400M ABS issuance backed by auto loans originated through Pagaya’s network of auto leaders.

Palmetto, a residential solar, battery storage, and heat pump provider, closed a $420M ABS issuance secured by a pool of 22,188 residential solar PPAs and leases.

Runway Growth Finance, a specialty finance platform for technology companies, acquired SWK Holdings Corporation, a life sciences-focused specialty finance platform.

Second Avenue, an asset-based lending platform, expanded its credit facility with Huntington Business Credit and a syndicate of banks to $700M.

Standard Premium Finance Holdings, an insurance premium finance platform, closed a $115M credit facility with First Horizon Bank and a syndicate of participants.

STORE Capital, an internally managed net lease REIT, closed a $625M securitization in its 14th note issuance under STORE’s Master Funding debt program.

SunStrong Capital Holdings, an asset management firm that owns over 110,000 solar loans and leases totalling 1 GW, closed a $900M residential solar ABS transaction.

USAA, a financial services institution, issued a $1.1B ABS deal secured by a pool of prime retail installment auto loans.

Yendo, a vehicle-secured credit card platform, closed a $50M Series B with investors including Spice Expeditions, Autotech Ventures, FPV Ventures, and Pelion Venture Partners.

Younited, a European consumer finance platform, closed a €400M warehouse facility with Citi backed by French and Italian consumer loans.

💰️Platform Growth

Ares raised $5.3B for a new infrastructure secondaries fund.

Brookfield agreed to acquire the remaining 26% interest in Oaktree at a $3B purchase price. Brookfield initially acquired 62% of Oaktree in 2019.

Brookfield completed its majority stake investment in Angel Oak.

Callodine Group is acquiring Corrum Capital Management, an asset-backed private credit firm with $1.4B AUM.

CVC Capital Partners closed €10.4B in capital for its European direct lending strategy.

Derby Lane Partners, an alternative asset manager focused on commercial real estate credit, launched with up to $1.8B committed from strategic anchor partners including Fortress, Koch Real Estate, Liberty Mutual, Silver Creek Capital, and Stable.

Eagle Point, Apple Bank launched Newton Commercial Finance, a new platform for infrastructure project and equipment finance.

Hudson Structured closed $719M in commitments for Hudson Northern Shipping Fund V LP, a direct lending fund focused on maritime companies for vessel acquisitions.

Incus Capital, a Madrid-based real assets private credit firm, did a first close on 50% of the firm’s target fund size of €800M.

Manulife Investment Management closed a $5.5B infrastructure fund.

Pursuit Funds launches an Asset-Based Income interval fund.

Titan Aviation Leasing, Bain Capital, and Atlas Air launch second freighter aircraft investment platform with $410M capital commitment.

Vistina, a subsidiary of Hoplon Capital, and HPS announce collaboration to expand Asset-Based Financing origination to borrowers.

📈 Visuals

🗣️ Market Commentary

“This stuff has been grotesquely overcapitalized…[Debt markets are] “part of the greatest bubble that ever was, and there will be shocks in the system when the froth is exposed.” - Dan Zwirn, CEO of Arena Investors on the recent high profile credit impairments

“The process for us is, and the importance for us is, to make sure we have a consistent set of underwriting standards and that we have robust upfront due diligence that we have ongoing monitoring and reporting, that we diligence underlying collateral that we manage the granularity of our portfolio within our own internally set diversification and concentration limits and that we have consistent standards for what we expect the risk return characteristics to be. Part of the key to credit underwriting is to make sure that you miss some of the more challenged credits. And that all comes down to upfront diligence and having a long-standing track record and an ability to be selective.” - Dennis Coleman, Goldman Sachs CFO on how GS manages risk in its financing business and collateral integrity

“Overall, I would say the NBFI exposure is predominantly investment grade. So that’s a consistent theme for us as a firm, certainly is the case as it relates to how it’s reflected in this disclosure. That means we’re working with top-tier asset managers that are sponsors for private credit or established consumer platforms. We’re maintaining collateral pools that are well diversified with concentration limits. We’re ensuring that there are structural protections, including ample subordination that helps to result in the high investment-grade attachment point. And we’re monitoring all the underlying collateral, and we have transparency at the loan-by-loan level. And so when I kind of take a step back and look at that, we’re very selective from a risk perspective as to how we play across all of these subcategories, but particularly as it relates to private credit.” - Mark Mason, Citi CFO on Citi’s Non-Bank Financial Institution exposure and risk management

“You should assume that whenever something happens, we scour all process, all procedures, all underwriting, all everything. And we think we’re okay in other stuff. But I -- my antenna goes up when things like that happen. And I probably shouldn’t say this but when you see one cockroach, there are probably more. And so we should -- everyone should be forewarn on this one. And first brands, I put in the same category. And there are a couple of other ones out that I’ve seen that I put in similar categories. So -- but we always look at these things, and we’re not -- I’m nipping in. We make mistakes, too. So we’ll see. There clearly was, in my opinion, fraud involved in a bunch of these things. But that doesn’t mean we can’t improve our procedures.” - Jamie Dimon, JPMorgan CEO on JPM’s post mortems following the $170M charge-off from Tricolor and risk management for their NBFI financing business

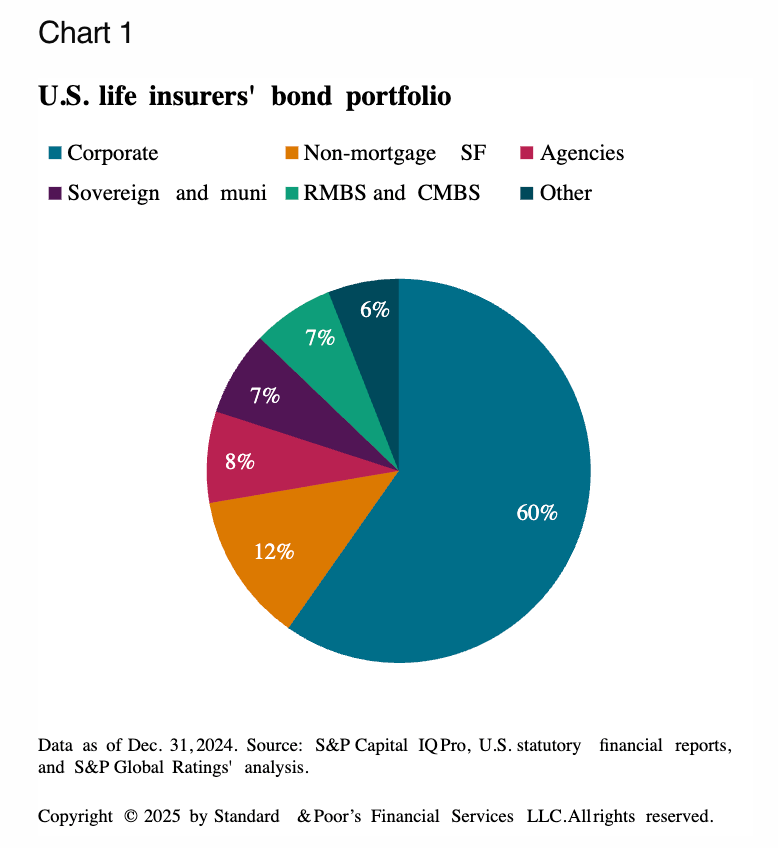

“We start with the fact that BlackRock is the largest insurance company general account manager in the industry with over $700 billion of assets across core fixed income. Insurance company asset management is a really highly customized effort working with clients every single day…So we think we’re in a great position effectively being extensions of the in-house team to help insurance companies rotate their portfolios to build great public private portfolios, in particular, with exposures to high grade. We have over 20 conversations going on now with the largest leading insurers in the general account about building private ABF and building private high-grade exposures. The team at HPS has brought some really terrific talent, both on the origination, asset management, but also the insurance solutions side. Those have been core skill sets with BlackRock as well, and being able to integrate all of that with Aladdin, we think will really allow us to grow and make meaningful progress here.” - Martin Small, BlackRock MD & CFO on Private Credit initiatives, post-HPS acquisition synergies, and growth areas

“I don’t think we’re seeing cracks in credit. I think what we’re seeing is some questionable lending practices from some folks that don’t frankly have the same resources and skillsets to play in the game. So First Brands is a great example. You look at who the big players were, the big lenders. They were not the big private credit firms. You did not see the Ares, KKR, Apollo, Blackstone. They were not playing in that company. It was in fact much more bank-oriented and hedge fund-oriented. So for us, this is simply a question of be careful who your partners are. There are a tremendous number of people providing capital in the market. There’s no shortage of capital. Investors need to focus on who they want to back, who they want to partner with. Because I don’t see a substantial problem with the sector or industry. What I see is variation, not surprisingly, across the actual individual players.” - Erik Hirsch, Hamilton Lane Co-CEO on perceived episodic, counterparty-driven issues versus systematic risks in private credit

📖 What We’re Reading & Listening To

Invester Presentations

Reading

4Q2025 Global Credit Outlook: Still Climbing the ‘Wall of Worry’ (BlackRock)

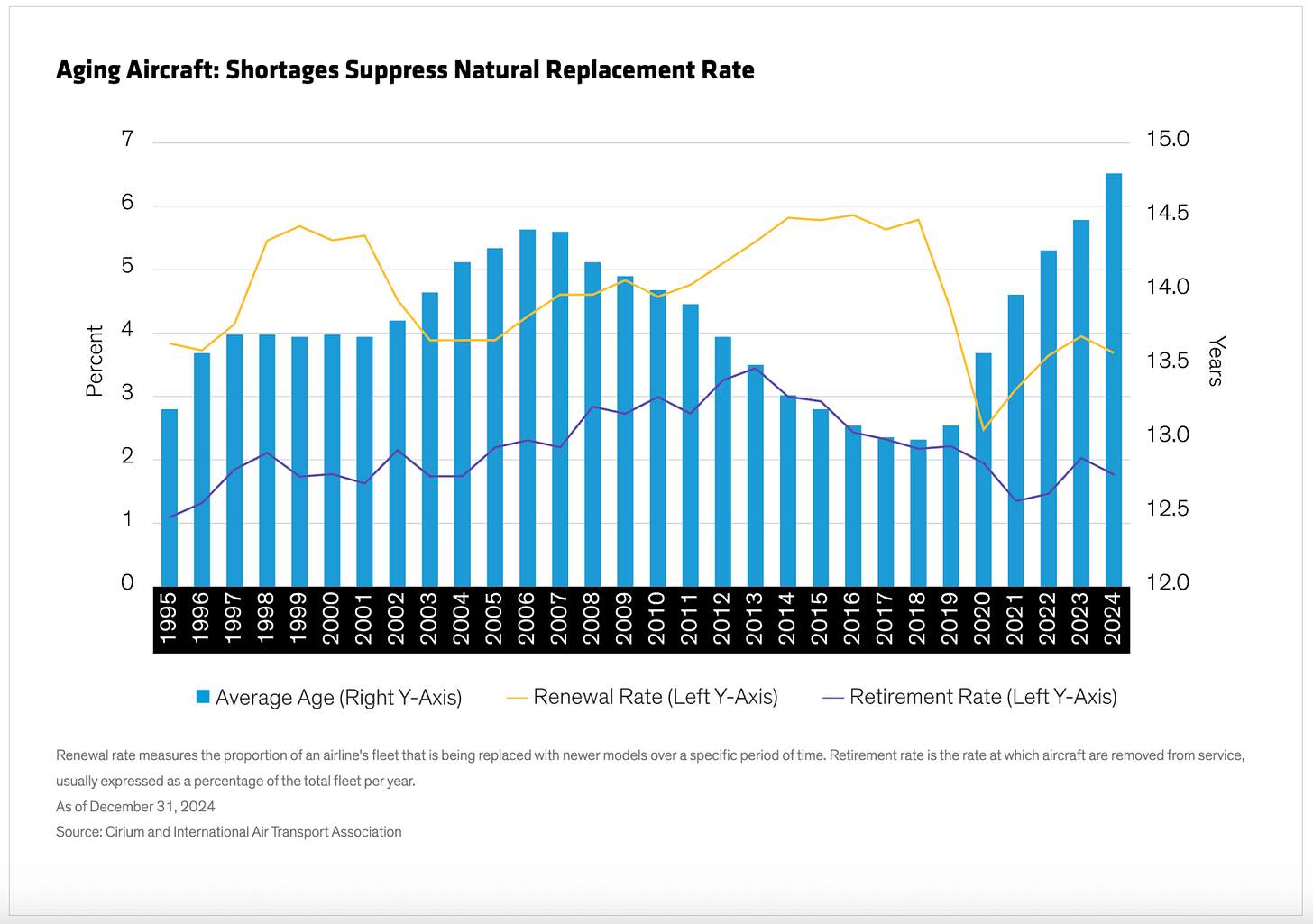

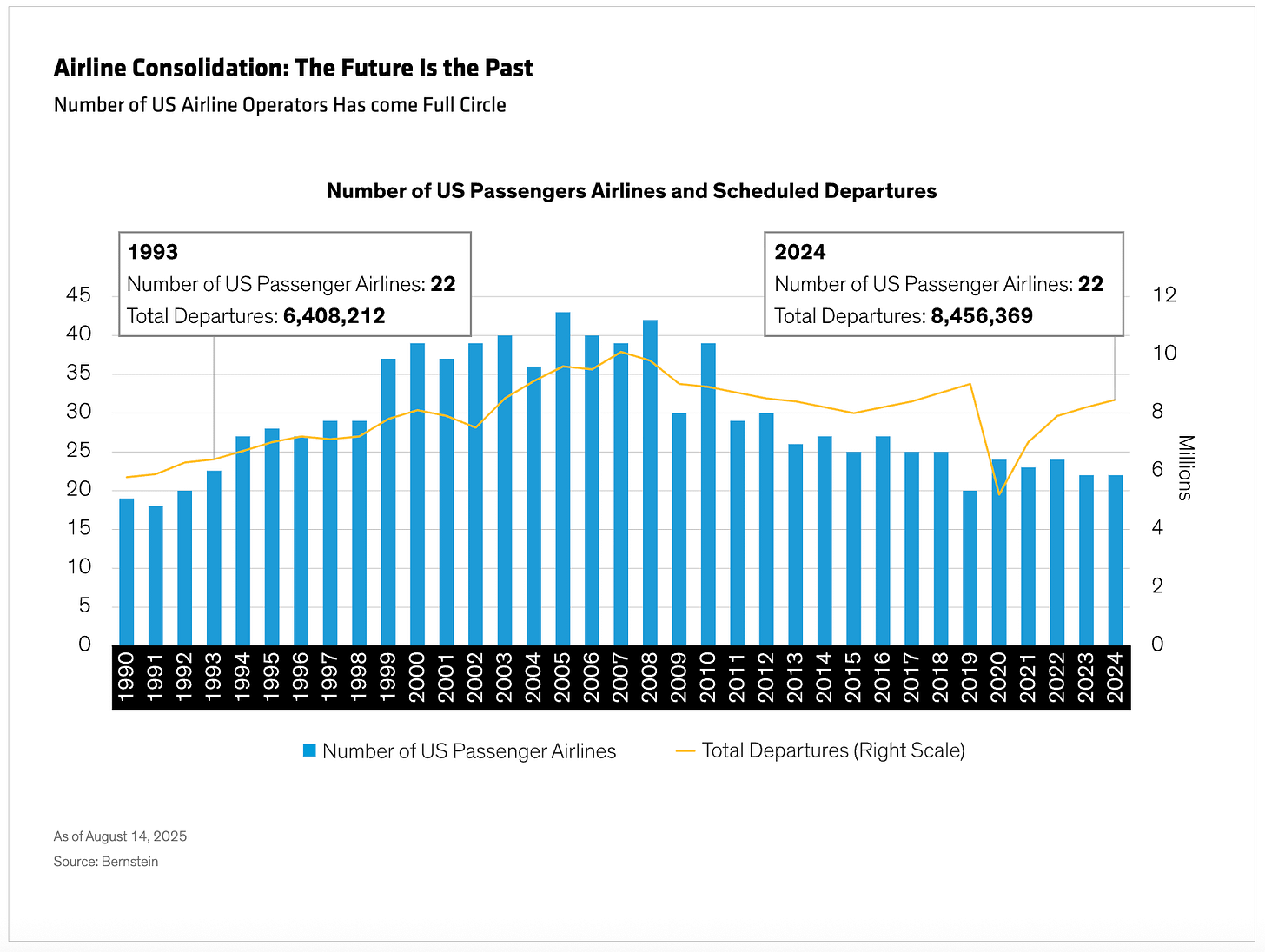

Aircraft Financing: Sunny Skies and Constrained Supply (AB CarVal)

Behind the Collapse of an Auto-Parts Giant (WSJ)

Music as an Asset Class (Stoikov, Sasha and Singla, Aadityaa and Cetin, Umu and Cendra Villalobos, Luis Alonso)

Outlook for Private Markets (Apollo)

Spectrum of Fund Finance Structures (Mayer Brown)

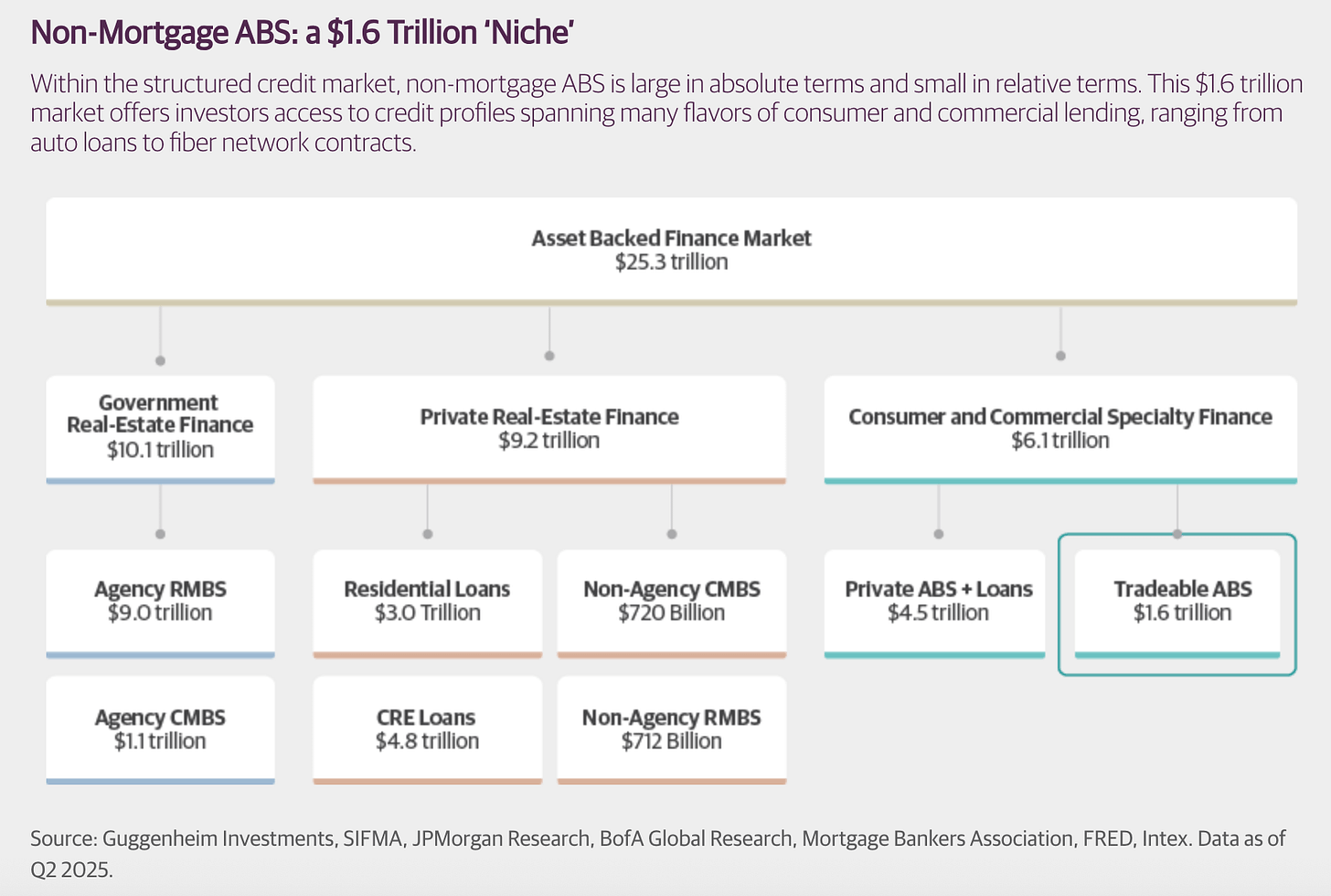

The ABCs of Asset-Backed Finance (Guggenheim)

US Structured Finance Notable Moves 2025 (RCQ Associates)

Podcasts & Interviews

Celebrating 35 Years of Memos with Howard Marks (Oaktree)

John Graham - Evolution of the Canadian Model at CPPIB (Capital Allocators)

Origination: The $40 Trillion Engine of Private Credit (The View from Apollo)

PGIM’s Phil Waldeck - The Intersection of Insurance and Asset Management (AGM)

There’s Tremendous Fragility in the System - PGIM Co-CIO Greg Peters (Debtwire)

The $5.3B infrastructure secondaries fund raise by Ares is impressive - reflects strong LP demand for liquidity solutions in infra. Infrastructure secondaries is a natural adjacency given their infrastructure equity platform and the maturation of the asset class. The fundraise size positions them competitvely with specialist secondaries players. Your commentary on counterparty risk vs systematic risk in the market commentaries section resonates - the First Brands and Tricolor examples show the importance of platform quality and underwriting depth.