Removing Some Complexities Around Insurance

“Nearly everyone has a supercomputer in their hand allowing them to “showroom” almost everything. Margin from information asymmetry is…

“Nearly everyone has a supercomputer in their hand allowing them to “showroom” almost everything. Margin from information asymmetry is gone.” — Tren Griffin

“Disruptive innovation” has made its way into the public lexicon over the last few years as the rise of companies like Amazon, Uber, AirBnb, and Lending Club have challenged our conventional understanding of how business works. The growth of lean startups with agile business models and a customer-centric approach has become increasingly common. This notion of ‘disruption’ is increasingly misused and misunderstood with respect to its original definition laid out by Harvard Business School Professor Clay Christensen in his 1996 book “The Innovator’s Dilemma.” In a December 2015 HBR article, Christensen attempts to set the record straight and clarify the meaning of the term, stating “In our experience, too many people who speak of ‘disruption’ have not read a serious book or article on the subject. Too frequently, they use the term loosely to invoke the concept of innovation in support of whatever it is they wish to do” (HBR). The distinction between innovation and disruption is increasingly opaque, but the expanded focus and awareness of the concept is not all bad. In every industry, we are more aware of the threats posed by new technologies, startups, business models, and pioneering thinkers. Technological developments and well-funded startups are shifting our conventional understanding of how industries operate and make money.

One candidate susceptible to massive change and business model reinvention over the next five to ten years is the insurance industry. Insurance has been an integral staple of the global economy since its inception around 3,000 B.C. It began as a risk mitigation and capital raising tool through a system known as “bottomry” — Chinese merchants were able to raise funds for voyages, while the financial backers of those voyages were able to hedge against the risk of a shipwreck. Fundamentally, the insurance industry has remained markedly similar over the last five thousand years. There have certainly been developments throughout its lifetime that have shifted the industry towards its current state, but change and innovation have been sparse in such a $4.5 trillion dollar industry (IIF). This blog will qualify that claim, explain the relative stagnation, and demonstrate the vast opportunity moving forward in the insurance industry.

Insurance has been and will always be a crucial part of the global economy. John Kenneth Galbraith famously said “there are two types of forecasters: those who don’t know, and those who don’t know they don’t know.” In a world where we can’t predict the future, we spend an awful lot of time trying to in spite of seemingly endless examples that suggest the futility of predictions. Whatever your view is on predictions and forecasts, the science shows that humans are, on average, not particularly good at it. Philip Tetlock, professor at Wharton and author of Expert Political Judgment, arrives at the conclusion that even those who dedicate their careers to predicting the future in their respective fields are no better than anyone else on average. Insurance, however, provides a tool to bring forth a more certain future in light of this pervading ambiguity.

Insurance often gets a bad wrap as a boring business, yet it provides imperative functions for households, businesses, items, and investments. Today, one can insure just about anything. Much of the reason why is due to the fact that insurance companies are usually playing a winning hand in the arrangement — they receive premiums from policyholders for X, Y, and Z. They pay the policyholder out in the event of an adverse event. But, as London Business School professor Elroy Dimson has said, “risk means more things can happen than will happen.” Thus, in the process of mitigating risk, you’re overlooking the probabilistic reality that that the thing against which you’re insuring has a very low probability of occurring. Yet, you do it anyway because you, your family, or your business need protection on the downside. Insurance companies, however, know very well the probabilities associated with respective events occurring. They are effectively making investments on the high likelihood that extreme events won’t occur, generating what’s known as a “float” in the process. Insurers receive premium payments from insurance holders, while they payout claims in the event of an adverse outcome. Meanwhile, this “float” is invested in a number of different asset classes. This has been a major driver of Warren Buffett’s success at Berkshire Hathaway over the past five decades. The insurance industry grew “in force over the period 1910–90 [at] approximately 8.4 percent [annually] — amounting to a 626-fold increase for the 80-year period” (Britannica). As is often the case, long periods of success and growth can breed complacency in spite of the many benefits accrued to those involved. The continued development of the industry throughout the 20th century didn’t necessitate any real drive to innovate. In the late 1990’s and early 2000’s, there was a progression towards developing online presence, price comparison tools, and aggregating information online. However, that was relatively consistent throughout every industry during the Internet boom. As a whole, the fundamentals of the industry haven’t changed much.

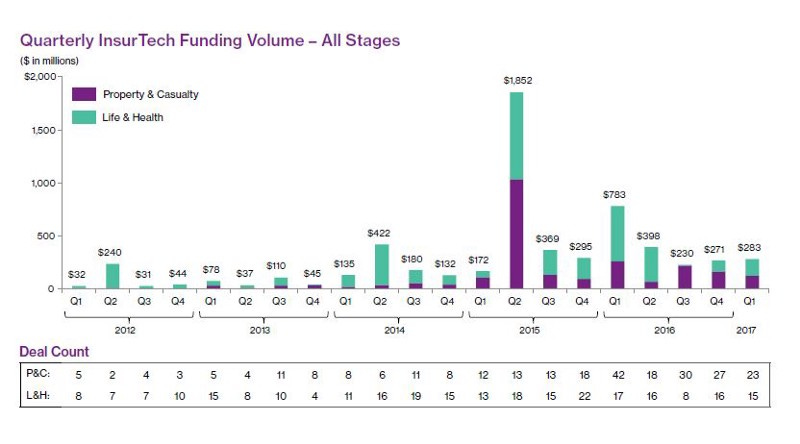

The insurance industry is undergoing significant changes and is starting to attract the warranted publicity that so many fintech startups have received since some of the high profile IPO’s from Lending Club and OnDeck in 2014. Incumbents are realizing that resting on their laurels is no longer sufficient. Scale and reputation are not nearly enough to sustain the dominant market positions that insurance and reinsurance firms have over the past half-century. Insurtech startups are accumulating capital rapidly. Since 2011, insurance tech companies have raised $5.67B across 464 deals. In total, financing deals to insurance tech startups rose 42% on a year-over-year basis in 2016 to hit 173 (CB Insights).

Two major drivers are instigating the impending changes in the industry. First, new technologies such as advanced analytics, artificial intelligence, blockchain, IoT, and the proliferation of digital services and distribution are being integrated in the insurance industry. The second impetus, which works in tandem with the technological innovations, is business model reinvention. Concepts such as on-demand insurance, usage-based insurance, and peer-to-peer (P2P) insurance are becoming more prevalent in an industry whose business model has remained static for centuries. Behavioral economics is also being incorporated into the industry as a way to restructure the behavior of both insurers and clients through smart design, forward-thinking incentive structures, and utilization of behavioral nudges.

Technological Innovations

Several new technologies have the potential to dramatically impact the insurance industry, vastly changing the conventional understanding and expectations surrounding how insurance works. Gartner defines the Internet of Things (IoT) as “the network of physical objects that contain embedded technology to communicate and sense or interact with their internal states or the external environment” (Gartner). The data generated from smart devices in the IoT ecosystem equips insurers with vast amounts of information that can be leveraged to assess risk prospects and update underwriting models with real-time information. According to research from Intel, there were 2 billion connected devices in 2006 and an estimated 200 billion by 2020 (Intel). Another major shift is digitization, which has proliferated in every industry as customers expect more out of their purchasing experiences. Insurance is no exception. In a 2015 survey conducted by Bain that included over 70 global insurance companies, respondents stated that between 20–40% of physical activities will move to digital channels in 3–5 years (Bain). Some specific processes that will migrate to digital channels include customer relationship management (CRM), which will move towards a more real-time, interactive experience with a 360-degree view of clients’ social media engagement, mobile application interaction, and data from IoT sensors. More insurance companies will undercut conventional sales channels, moving towards a direct-to-consumer distribution strategy. We’ve seen this already with the likes of startups such as Oscar Health, Clover, and Canopy. On the business side, Embroker and CoverWallet are attempting to simplify the buying and management of corporate insurance policies.

The incorporation of advanced analytics might be the most important innovation in the insurance industry over the next few years. The insights generated from customers’ sizeable, expanding digital footprints will allow insurers to create and maintain comprehensive, real-time client profiles. PSD2 has mandated an open policy when it comes to customer data sharing throughout the EU. This trend has begun in the U.S., particularly with respect to personal financial management (PFM) and retail banking. Insurance can also reap many of the benefits of third-party API’s as well. The dual impact of advanced analytics and integrated external data will dramatically impact the underwriting, pricing, and risk selection processes as insurers move towards predictive modeling and automation. Data analytics can also screen applicants to get a very detailed picture of any fraud-related history of applicants and clients. In Property and Casualty insurance specifically, the development of the connected home with companies like Nest, Ring, and Hive offers data around safety, security, and oversight of homes in a way that previously wasn’t possible. The development of telematics, which involves the collection, transmission, normalization, and analysis of vehicle and driving behavioral data, will serve as the foundation for modern automobile insurance (FT Partners). The predictive and prescriptive insights generated about insurance customers will equip insurers to assess the relevant risks of their customer and quantify them in such a way that customers are paying what they ought to pay.

Blockchain is another technology that has massive potential to upend the conventional insurance industry. Smart contracts, the self-executing contracts stored on the blockchain, remove the need for direct human involvement because system-related processes become automated. Beyond the simple automation, blockchain solves one of the pervasive problems that has plagued insurance since the industry began — the conflicts between the parties involved. With blockchain’s immutable record, there would no longer be a distinction between one party’s interpretation of the a scenario versus a conflicting perspective. Instead, blockchain presents a “single version of the truth,” removing the need to validate an inevitably biased perspective. Digital identity can also be built upon the blockchain such that every record is updated in real-time and accessible to every network participant. This universal system of identification provides insurers with every relevant piece of information for individual clients, businesses, and property. Another major value add from blockchain is fraud prevention. Transactions on blockchain are timestamped and immutable, so identities are secure and data is trustworthy and uniform. Thus, insurance fraud would be much easier to detect and avoid in the first place. This could present massive cost savings for insurers as estimates suggest that roughly 60% of insurance fraud goes unnoticed in US and Europe (EY). According to EY, blockchain could “eliminate error, negligence, and detect fraud by providing a decentralized digital repository to independently verify the veracity of customers, policies, and claims” (EY).

The development of AI will also play an increasing role in insurance as the underlying technologies continue to advance. Some of the potential value adds include enhanced automation, reduced risk and expense, increased productivity, and the facilitation better decision-making. Artificial intelligence will enable insurers to assess clients’ risk profiles and even handle the underwriting of said customers. AI systems can also help with claims management and fraud detection. From a client engagement standpoint, AI and chatbots will revolutionize the way in which customers interact with their insurance companies. This will enhance the engagement between parties in a relationship that has historically been far from amicable. The real-time collection of data will inform insurers with insights regarding their clients’ specific needs. Not only will this allow insurers to provide services that appeal to customers based on their specific needs, but it will also tailor the customer experience based upon their preferences and engagement trends.

Business Model Reinvention

In Dan Pink’s most recent book titled “To Sell is Human,” he recalls the catch phrase that has characterized the historical business relationship between firms and customers: “caveat emptor.” This notion stems from the fact that firms naturally have an informational asymmetry due to their superior knowledge of the product or service they’re selling. For most of history, this has been a prevailing theme and a defensible business strategy. Pink highlights that business has moved towards “caveat venditor” — seller beware. Financial journalist and venture capitalist Morgan Housel expands on this change in a recent report saying, “when information is expensive, as it was in my parents’ generation, you could get away with keeping the truth away from your customers. You could hide behind information barriers. That’s no longer the case” (Collaborative Fund). The digital age has brought about a transparency and active repository of knowledge that effectively levels the playing field between buyers and sellers. The buying experience has become exponentially simpler due to price comparison sites, curated reviews, and endless information at the click of a button. Those who embrace this shift to transparency and customer engagement will be the winners, irrespective of industry. Vanguard and Amazon are two clear examples of the ROI associated with putting the customer first. Startups across industries are also aligning their product strategy and business model around customer-centricity and transparency. Companies simply cannot afford to keep their customers in the dark.

In the insurance industry, however, the relationship between the insurance company and the customer is relatively outdated. The crux of this issue stems from the business model dynamics in insurance. From the standpoint of the insurance company, they make money when they don’t pay out their claims. They receive an annuity from each customer in exchange for protection in the case of some adverse outcome. Customers buy insurance to protect against future risks. Insurance historically has been viewed as one of the least trustworthy industries on the planet. Insurance companies make a profit in two ways — via investing their float and making an underwriting profit, which is generated from taking in more in premiums than you pay out in claims. Inherently, there’s an incentive to put up some hurdles so that claims aren’t paid out without a fight. On the other side of the table, claimants have an incentive to exaggerate their claims — potentially taking in more than they should as a result. Insurance fraud, defined as material misrepresentation of claims, is a legitimate threat and one that “accounts from 5–10 percent of claims costs for US and Canadian insurers. Nearly one-third of insurers (32%) say fraud was as high as 20% of claims cost” (InsuranceFraud.org). In the insurance industry, both the buyer and seller ought to beware. There is a conflict of interests among the two parties who ought to be helping each other.

Startups such as Lemonade, a peer-to-peer insurance company for renter’s and homeowner’s, are attacking this misalignment of interests head on. The company is hoping to reinvent the industry through transparency and technology.

Unlike traditional insurance companies, Lemonade takes a 20% flat rate and returns whatever is leftover at the end of the year to a cause that each customer specifies. Not only are they saving clients money, but they’re also neutralizing a historically adversarial relationship. As CEO Daniel Schreiber said in a recent interview with Wharton Fintech, “The benefits of it are though readily apparent which is that I never make money by denying your claim, I’m not in conflict with you. In fact when you make a claim I have every interest to pay it to you because it’s not my money anyway and just letting the claim drag on just puts us at odds for no benefit to me whatsoever” (Wharton Fintech). Lemonade has also hired author and Duke behavioral economics professor Dan Ariely as Chief Behavioral Officer. Behavioral economics lies at the core of what they’re trying to do: by effectively eliminating the conflict of interest inherent in conventional insurance relationships, the hope is that they will nudge the customers in such a way that the relationship between insurers and clients is improved as the interests of both parties become aligned.

Moving forward, consumers will continue to control the agenda in their relationship with insurers. Insurers, too, will focus on consistent, personalized engagements with their customers. Amidst these technological and business model changes, there is an opportunity for continued partnerships between incumbent insurers and startups in the space. Corporate VC arms have poured money into a number of insurtech startups and engaged in partnerships with many startups as well. The opportunity for inciting change and spurring innovation is compelling and acknowledged by insurance executives. Startups are continuing to get involved in the space — some of which have transitioned more recently, such as SoFi. What’s left to be determined is the adoption rate of these new technologies. As we’ve seen in the fintech space more broadly, there are a number of phenomena that appear to be good ideas. They develop strong support. And time passes, but these ideas don’t blossom to the size and scale that was expected. That’s not to say that they won’t. It’s just not easy to predict.

As the development of insurtech continues to expand, there are several thoughts worth considering:

Hype vs. Reality? → There are endless articles and papers about the unraveling of industry leaders due to a new technology, a more refined customer focus, or some flavor of the day terminology.

Technical Debt → What can incumbents afford to do? What are they willing to do given their aging legacy systems? Can cost savings and technology benefits be realized any time soon?

Initiating Behavior Change → Despite our best efforts, people don’t always do what we want them to do. There is endless literature on the subject of behavioral economics discussing the difficulties around getting customers to change in spite of copious reasons supporting that change. (More on that here)

How do incumbents monetize these changes? → This issue relates to short-term vs. long-term thinking. It can be difficult to rationalize potentially beneficial decisions when those purported benefits won’t accrue for 5+ years

Incumbent options? → Do incumbents pursue the CVC route? M&A? Incubators? Hybrid? (Fred Wilson shares his views on CVC here)

Too much money chasing too few good ideas? (Recent example of departing from core competency to chase “good ideas” here.)

Scalability for startups? → How do you scale? How do you reduce your customer acquisition cost? (Expanded ideas here)