First Republic: Sequoia's Weirdest Investment

Why Sequoia invested in one of the best banks in the US

SEQUOIA DEVIATING FROM THE PLAN?

Sequoia Capital has been an early investor in the most successful technology companies of the last half century. Apple, Cisco, Google, Oracle, Square, Whatsapp, and YouTube are just a few.

Sequoia is regularly listed among the most successful venture firms of all time. Despite their old age (founded in 1972), their pace hasn’t stalled. They are investors in some of the fastest growing tech companies around the world, with a separate fund focusing on China.

So why did they invest in a 25-year-old, brick-and-mortar bank in 2009 in the form of a buyout from Bank of America alongside two of the largest private equity firms around?

First Republic might be the best bank you don’t know enough about. They’re as traditional as they come: good, old-fashioned relationship banking. They offer private retail banking, wealth management, home & CRE lending, and business banking in a few of the wealthiest zip codes in the US.

90% of their loans since 1985 have been originated by bankers still at the company

Of the $300B+ in loans originated since 1985, they’ve seen 11 basis points of cumulative net losses

Higher NPS than Ritz Carlton, Apple, and Netflix

They’re not flashy, but FRC’s growth since its IPO in 2010 has been phenomenal.

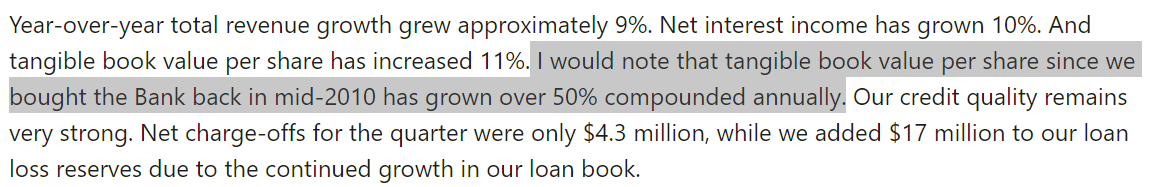

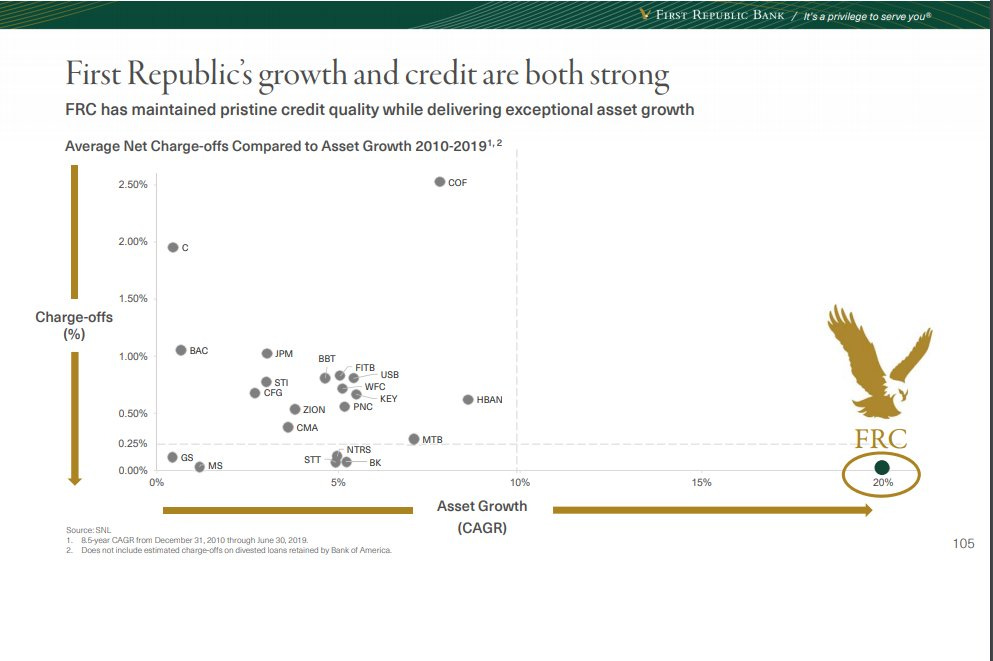

Over the past five years, the bank has generated compound loan and deposit growth at +19%, wealth management AUM at +23%, and Tier-1 capital at +16%. Their ability to manage asset growth in a disciplined, responsible manner is unrivaled, as evident by the slide below.

Q3’20 performance continued to impress, exceeding a record quarterly for loan originations. Net Interest Margins have been stable despite declines across the industry in aggregate. Despite the continued asset growth, the bank’s philosophy remains the same: “Our job is to maintain our service quality. If the service quality is maintained, the growth will be maintained.”

COMMODITIZATION: HOW DIFFERENT CAN YOU BE?

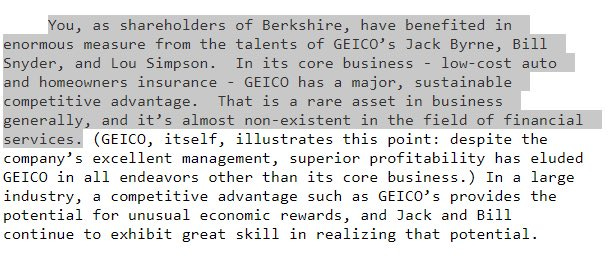

Banking is inherently a commodity industry. Buffett highlighted this well in his 1984 letter. In reference to GEICO, he said “major competitive advantages…are almost non-existent in the field of financial services.”

In the 1990s, Sandy Weill of Citigroup fame also harped on the commodity-like nature of financial products. He focused instead on having the lowest-cost delivery system, which he believed was the most effective way to compete at scale. That paved the way for an M&A-fueled growth strategy that united a myriad of loosely related businesses. That led to the financial supermarket model that offered everything to everyone. Most of the “synergies” weren’t realized.

The more things change, the more they stay the same. Financial products today are certainly more commoditized than every before amid heightened competition, increased digitization, and higher customer standards. The value accrued from new product development is often ephemeral because competitors can easily copy them.

Even on the private market side, new product innovation in consumer fintech tends to be quickly emulated by competitors. While it may be an effective acquisition tool, as in the case of Chime’s 2018 launch of early-pay access, there’s a short window before the product or feature becomes table stakes across the indstry. There are similar dynamics now across the biggest retail banks launching low or no-fee checking accounts, accounts catering to teens, and small dollar lending products.

CLIENT SERVICE AS THE STARTING POINT

Despite the Sequoia investment, First Republic is anything but a startup. They were founded in 1985 in San Francisco and have established themselves through strategies that appear to fly in the face of conventional wisdom for a bank in 2019. They’re opening new branches, they’re spending very little on acquiring customers, and they epitomize customer centricity in an industry that often misses the mark in that department.

Much like Tony Hsieh viewed Zappos as a customer service company that happened to sell shoes, Ensemble Capital has called them a customer service franchise disguised as a bank. Their NPS exceeds some of the most valuable luxury brands in the world. Client retention vastly exceeds peers. Service is engrained in the culture.

As the banking industry has become digital by default, banks have funneled billions into their transformation efforts over the past few years to enhance customer experience. They have also focused on pushing customers to digital channels, where customers are more engaged, cheaper to serve, and approachable for a cross-sell.

Many of the venture-backed challenger banks have opted for a mobile-first customer focus. And that's probably the right strategy for a bank going forward. But one thing that they have tried to skirt is conventional customer service channels. Chime's biggest pushback from customers is the level of effort required to get a service rep on the phone.

First Republic has been playing a different game than most of its banking peers. As Sean Stannard-Stockton of Ensemble Capital said, “Herbert recognized that while the banking industry primarily competes via pricing (offering premium yields on deposits or attractive rates on loans), there is a segment of customers who are more interested in superior customer service.” This, in turn, gives First Republic a level of pricing power that most banks don’t have. It also removes distractions.

“In an industry where competitors view customer service as a cost to be minimized, they view it as an investment in their moat.” - Ensemble Capital

MANAGING CUSTOMER ACQUISITION COSTS

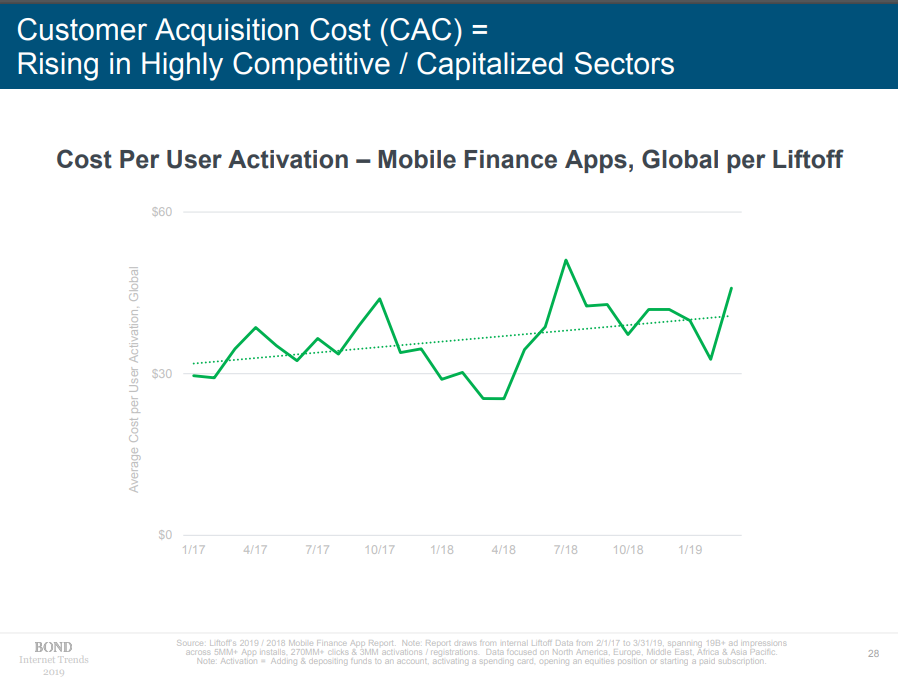

Customer acquisition is one of the biggest hurdles for banks and fintech startups. And those costs continue to rise as fewer players compete for the same customers.

Meanwhile, First Republic has developed a brand equity that does the marketing department’s job for them. 50% of their growth comes from existing clients. Another 25% comes from word-of-mouth referrals. And they see 2% annual attrition, compared to an 8% average across the industry. On top of that, the referred prospects are more likely to be clients First Republic wants.

The singular, disciplined focus on client service has compounding effects that do a lot of the work for First Republic.

STUDENT LENDING AS AN ACQUISITION TOOL

As a pseudo-private bank, First Republic’s client base skews older. But they’ve maintained a strong and growing pipeline of millennials through their Student Loan Refinance and Professional Loan Programs. Collectively, the relationships acquired through both programs represent over ⅓ of their total consumer borrowing households.

As Jim Herbert highlighted in a previous earnings call, the student loan program drives 8,000-9,000 new clients each year, and their credit profile is often better than the single-family residential clients. Specifically, that means higher deposit-to-loan ratios, stronger incomes at their age groups, similar FICOs, and higher levels of education.

“The student refi product and the Professional Loan Program products... are running about the same as last year, which was a tremendous growth year and the deposit-to-loan ratio inside that portfolio was stronger this year than it was, which is indicative of the fact that we are their full-service bank. We're right around 25,000 such households at this point in the Bank and we actually couldn't be more delighted with the progress.” -- Jim Herbert, Founder & CEO on Q3 earnings call

The company had acquired Gradifi in 2016 to accelerate the student loan refinancing program, but sold it to E*Trade late last year. I was somewhat surprised by this move as I thought it was an interesting way to enhance the student refi channel. That said, they sold it for $30M and are remain a lender in the Gradifi marketplace. As is the case with many fintech acquisitions from incumbents, it sounds like it may not have really moved the needle.

DIFFERENTIATION IN A COMMODITY INDUSTRY

First Republic is opening new branches, acquiring millennial customers, and garnering more trust than some of the most elite luxury brands in the world. There are few better examples of a full-stack, relationship bank than First Republic. The company provides a fascinating case study for long-term profitable growth in a commodity industry.

They operate in select markets, catering to high-net worth clients, with a single point of contact for those clients. They attract high quality clients and their differentiated service model gives them pricing power. Their clients aren’t looking for 10-20 extra bps on a savings account. First Republic knows their markets really well and have effectively been able to manage and grow their real estate loan portfolio, which consists mostly of single-family residential. The loan mix is effectively the same as it was 20 years ago.

For First Republic, culture and focus is a legitimate moat in an industry that’s often devoid of cultural assets.